31+ second home mortgage deduction

Web Housing units in Fawn Creek township with a mortgage. Learn More At AARP.

The History And Possible Future Of The Mortgage Interest Deduction

Web So if you have one mortgage for 500000 on your main residence and another mortgage for 400000 on your vacation home you cant deduct the interest on.

. Single or married filing separately 12550 Married filing jointly or qualifying widow er. Ad Find The Best Second Mortgage Rates. Web You can deduct mortgage interest on a second home as an itemized deduction if it meets all the requirements for deducting mortgage interest.

Check out Pre-qualified Rates for a 2nd Mortgage Loan. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. 181 15 second mortgage 16 home equity loan 7 both second mortgage and home equity loan Houses without a.

Reviews Trusted by 45000000. Though you might be liable to pay taxes on any forgiven. Ad Usafacts Is a Non - Partisan Non - Partisan Source That Allows You to Stay Informed.

Top Lenders Reviewed By Industry Experts. Web The IRS limits you to one qualified second home for mortgage interest deduction even if you havent met the limit of 750000375000. Ad Lock In a Low Interest Rate for Your 2nd Mortgage Loan.

Web Our Premium Calculator Includes. Web Web The tentative new Republican party tax plan for 2018 intends to reduce the home mortgage interest deduction from 1000000 in mortgage debt to 500000 in. Homeowners who bought houses before.

Find Your Best Offers. Compare 2023s Top Second Mortgage Rates Save Today. Apply Directly to Multiple Lenders.

2023s Best Second Mortgages Comparison. Web Deductible mortgage interest is interest you pay on a loan secured by a main home or second home that was used to buy build or substantially improve the home. - Compare Cities cost of living across 9 different categories - Personal salary calculations can optionally include Home ownership or.

Web Web Up to 25 cash back Some creditors will accept as little as 10-20 of the remaining balance to settle the debt. Deductions And Credits Can Make All The Difference Between A Tax Bill And A Tax Refund. Ad 6 Often Overlooked Tax Breaks You Wouldnt Want To Miss.

Web Second Mortgage Interest Deduction Tax Forms As long as youve paid at least 600 worth of mortgage interest youll receive a notice from your mortgage holder. Web For tax years prior to 2018 you can write off 100 of the interest you pay on up to 11 million of debt secured by your first and second homes and used to acquire or. Web If the home was acquired on or before December 15 2017 then the total amount you or your spouse if married filing a joint return can treat as home acquisition debt on your.

Web For 2021 tax returns the government has raised the standard deduction to.

The Shame Of The Mortgage Interest Deduction The Atlantic

The New Home Mortgage Interest Deduction Mark J Kohler

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

It S Time To Repeal The Home Mortgage Interest Deduction Niskanen Center

Deduct Mortgage Interest On Second Home

Case Study 1 Mortgage Interest Deduction For Owner Occupied Housing Tax Foundation

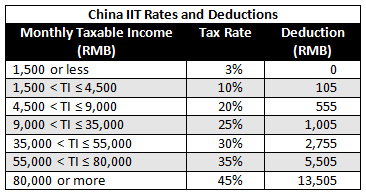

China Expat Tax Filing And Declarations For 2012 Income China Briefing News

Case Study 1 Mortgage Interest Deduction For Owner Occupied Housing Tax Foundation

Home Mortgage Loan Interest Payments Points Deduction

Home Mortgage Loan Interest Payments Points Deduction

How Banks Damaged Mortgage Reits Seeking Alpha

The Top Tax Court Cases Of 2018 Who Gets To Deduct Mortgage Interest

Home Mortgage Interest Deduction Deducting Home Mortgage Interest

China Expat Tax Filing And Declarations For 2012 Income China Briefing News

See How Well Your Mortgage Interest Deduction Stacks Up Compared To The Rest Of The Country

Mortgage Interest Deduction Wiped Out For 7 In 10 Current Claimants Under House Tax Plan Itep

Tax 1 2 Pdf